Ventus is seeking capital from wholesale investors to fund T4 to financial close, accelerate its pipeline of wind farm developments and capitalise on favourable trends in the renewable energy sector.

As an illustration of the potential investment return, Ventus believes that if it achieves key milestones for its lead two projects in the next 12 months, as planned, the value of Ventus Energy could increase by between 2x and 4x.

Further information is available, including an information memorandum and supplementary information about the project valuations. To request additional information log in, confirm your agreement to the confidentiality terms, and click the ‘Learn more’ button below. We will be in contact within two business days.

Note: This offer is only open to wholesale investors.

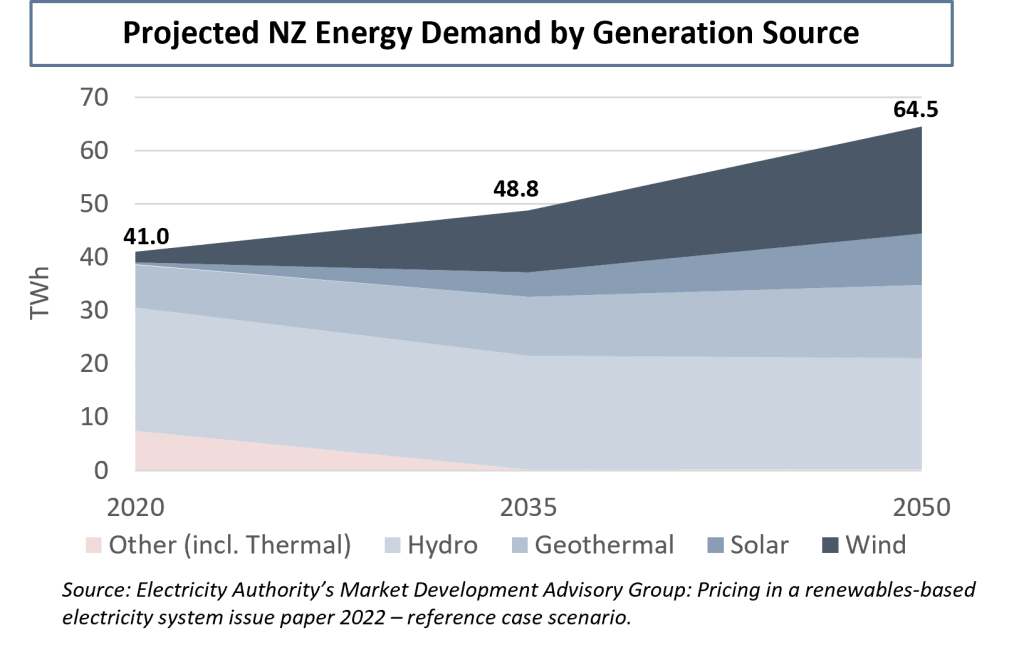

Significant Demand Growth – NZ requires c. 1,100 GWh of new renewable energy generation p.a. for the next 30 years, the majority of which will come from wind.

Significant Demand Growth – NZ requires c. 1,100 GWh of new renewable energy generation p.a. for the next 30 years, the majority of which will come from wind.

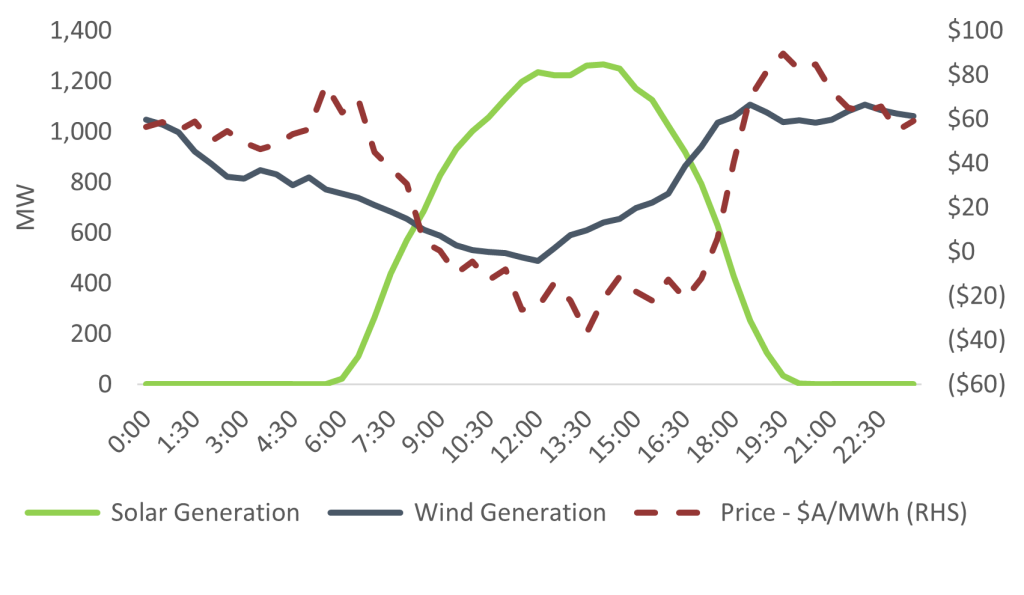

Peak Price Capture – Wind generation’s daily peaks (early morning and evening) and seasonal peaks (winter and early spring) match the timing where demand and pricing are strong. The daily peak is illustrated with Australian data below, as their market is well developed in both wind and solar, unlike NZ.

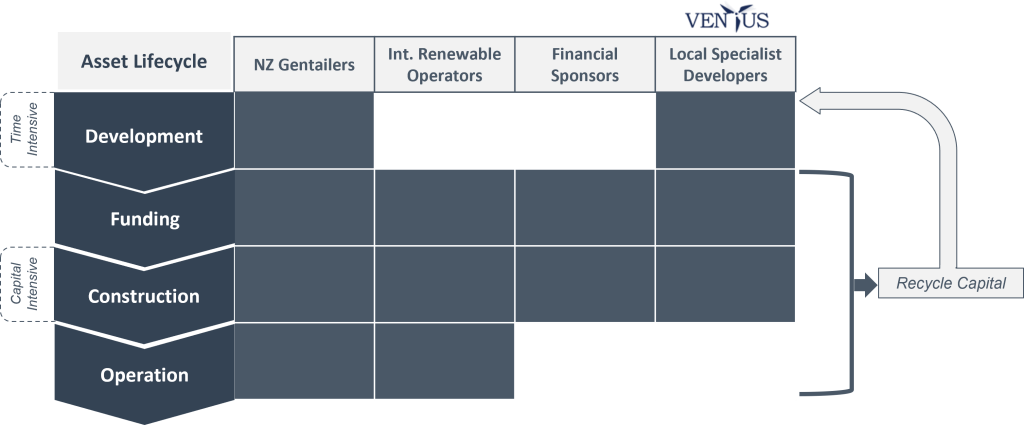

Ventus aims to create a diverse portfolio of operating wind farms that will be attractive to the public markets or overseas operators who do not have the expertise to enter the NZ market at the development stage. In the course of this, Ventus will seek to release and recycle capital from construction or operation phase projects (e.g. by introducing infrastructure investors at the asset company level) to accelerate its overall development pipeline.

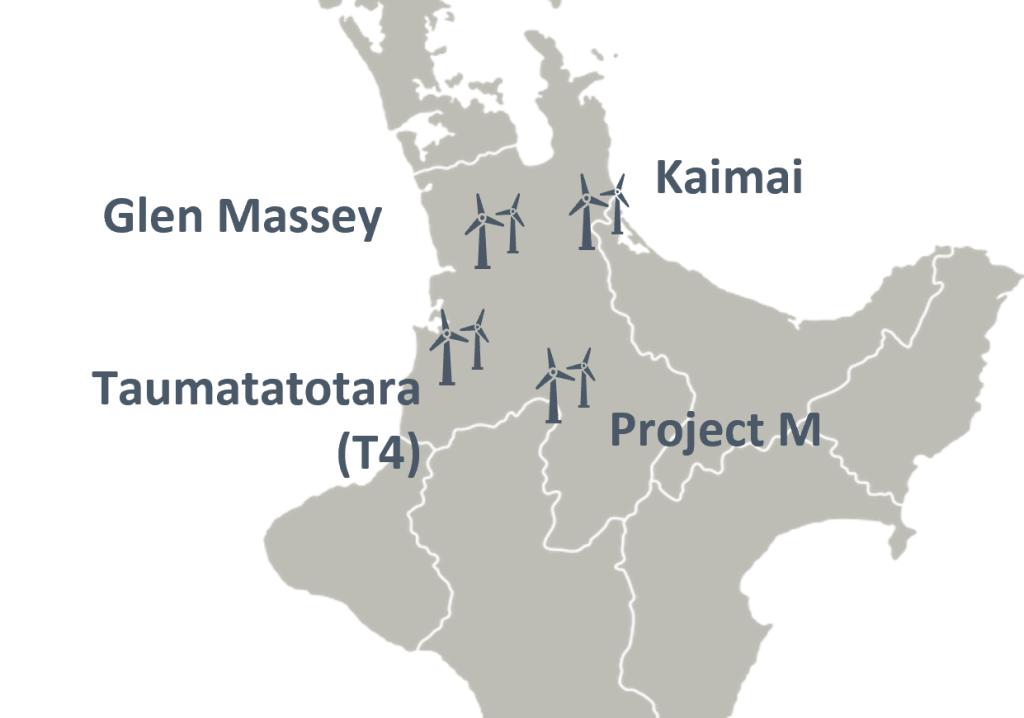

Ventus’ developments are focused on the Upper North Island, which provides proximity to NZ’s highest centre of demand. This location provides higher wholesale electricity prices and a greater concentration of businesses seeking to sign offtake agreements for verifiable green energy.

Ventus is led by a highly experienced and passionate management team, who are committed to creating a transformative renewable energy platform that will benefit NZ.

• Founded Ventus NZ in 2004 and Ventus Ireland in 2000. Successfully exited two wind farm project

• Significant experience in alternative energy having initiated wind energy and electric bus businesses in NZ

• Previously civil engineer for 10 years including with Beca

• 30 years’ experience in project design, procurement and technical services across construction, pipelines, airports and civil structures.

• Background as a professional engineer in NZ and abroad

• Responsible for strategy around electricity pricing, hedging and PPAs

• Over 30 years’ experience in the energy sector including as GM Trading for Vector and GM Generation Ops for Contact Energy.

• Responsible for overseeing wind data collection, and energy assessment

• Over 20 years’ experience in wind energy implementation, including turbine procurement, installing over 100 meteorological masts

• MBA, CFInstD with 30+ years of experience as a business leader, founder, CEO and Director across a variety of industries in New Zealand, Australia and the US.

• It is intended that two independent directors are appointed prior to or in conjunction with the capital raise. Ventus is currently in discussion with several highly skilled and qualified candidates for a second independent directorship position.

• Investment banking and advisory professional with a 19 year track record in infrastructure investment and project finance. Previous experience with HSBC, World Bank Group and H.R.L. Morrison & Co.

• Energy financier with over 25 years experience with JP Morgan Chase and Societe Generale. Raised and refinanced over $40bn across EMEA and Australasia.

Delivering fabulous projects with passion and perseverance.

Disclamier: By submitting this contact form, you confirm that you are a wholesale investor and grant Ventus Energy permission to contact you.